With over $19+ billion in assets under management, and an over 13-year heritage as a global owner and operator, we focus on investing in the backbone of the global economy, and are committed to supporting and enhancing the communities in which we operate.

We put our own capital to work alongside our partners’ in virtually every transaction, aligning interests and bringing the strengths of our operational expertise, global reach and large-scale capital to bear on everything we do.

1,200+

investment

professionals

~5000

operating

employees

30+

countries across five continents

2,000+

investments

globally

Our Businesses

As a leading impact investor, our

global platform provides innovative solutions to help

governments and businesses meet their decarbonization

goals.

- RENEWABLE POWER & TRANSITION SECTORS

- Hydro

- Wind

- Utility Solar

- Transition

We invest in infrastructure assets

that deliver essential goods and services to communities

around the world.

- INFRASTRUCTURE SECTORS

- Utilities

- Transport

- Midstream

- Data

We focus on acquiring high-quality

businesses with high barriers to entry and low

production costs, building value through operational

enhancements.

- PRIVATE EQUITY SECTORS

- Infrastructure Services

- Business Services

- Industrials

- Healthcare Services

We own and operate an irreplaceable

portfolio of iconic properties in the world’s most

dynamic markets.

- REAL ESTATE SECTORS

- Housing

- Logistics

- Hospitality

- Science & Innovation

- Office

- Retail

Delle is a global investment manager

with deep expertise in credit with a contrarian,

value-oriented and risk-managed approach to protecting

capital.

- CREDIT SECTORS

- Performing Credit

- Opportunistic Credit

- Direct Lending

Our Insurance Solutions business is

focused on providing capital-based solutions to

insurance companies and their stakeholders.

- INSURANCE SOLUTIONS SECTORS

- Reinsurance

- Annuities

- Operating Platforms

- Investment Solutions

INFOGRAPHIC

Evolving to offer the best of both worlds

With the launch of a publicly listed, pure-play alternative asset manager, we are moving into our next phase of growth.The Delle Advantage

Global Reach

The scale of our global operations allows us to draw from a wealth of actionable market intelligence and relationships, generating proprietary deal flow.

Large-Scale Capital

Our access to substantial, flexible capital lets us execute transactions of a size few others are able to.

Deep Operational Expertise

A history of owning and operating real assets and related businesses has taught us to leverage our operational expertise to enhance the value of our investments.

RECENT NEWS & INSIGHTS

Column | Delete your DNA from 23andMe right now - The Washington Post

Read More

China's electric carmaker BYD sales beat Elon Musk's Tesla - BBC.com

Read More

Stock futures edge down after major averages post back-to-back gains: Live updates - CNBC

Read More

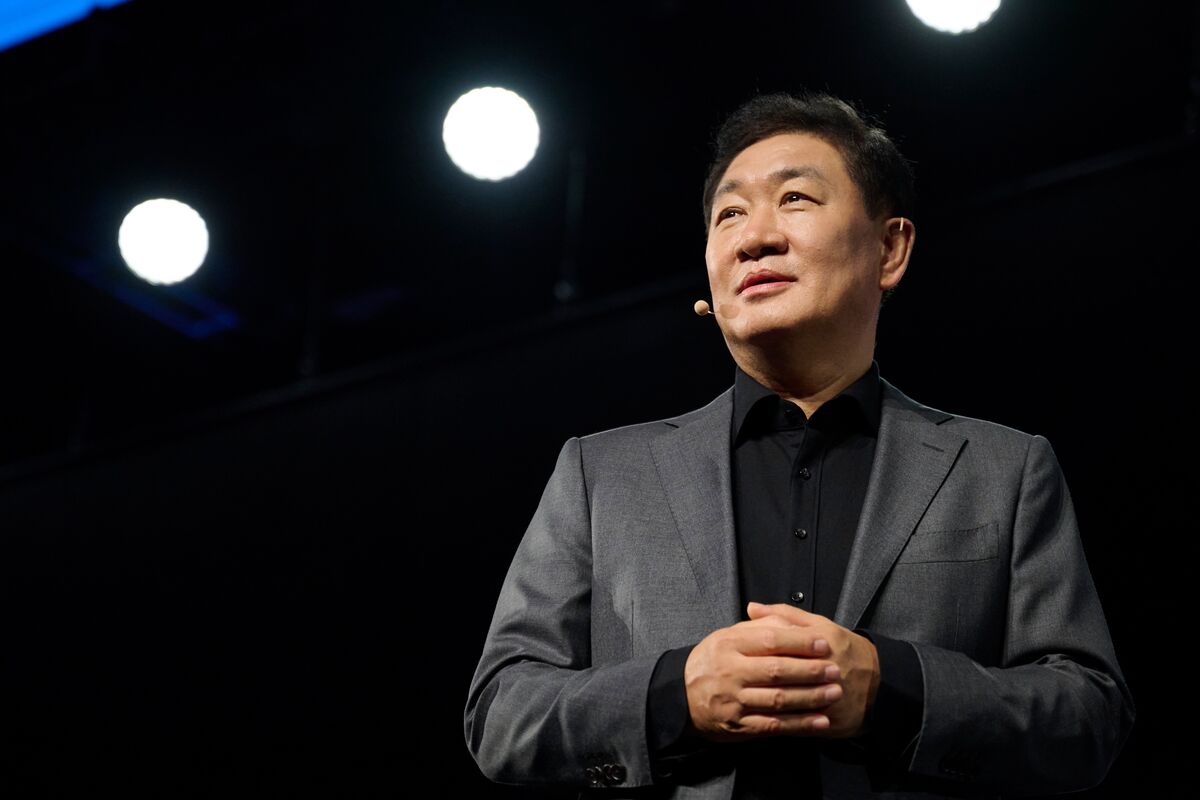

Samsung Electronics Says Co-CEO Han Jong-Hee Has Died at 63 - Bloomberg

Read More

Chase and United Airlines Detail Changes to Credit Cards - Upgraded Points

Read More

Surprising China news sends Tesla stock soaring - TheStreet

Read MoreSouth Florida man drives SUV into crowd of Elon Musk protesters at Tesla store: deputies - Miami Herald

Read More

The FBI launched a task force to investigate Tesla attacks - The Verge

Read More

Hyundai reveals multi-billion-dollar bet to dodge Trump’s tariffs and boost EVs in the US - Electrek.co

Read MoreOklo Stock Falls on Earnings. It Shouldn’t Surprise Nuclear-Energy Fans. - Barron's

Read MoreTrump Media Announces Intention to Partner with Crypto.com to Launch ETFs - GlobeNewswire

Read More

Berkshire Hathaway employee wins $1 million in Warren Buffett's March Madness bracket challenge - CNBC

Read More:max_bytes(150000):strip_icc()/GettyImages-2196355057-d6087c87a0fb4c9d93777779176ac1d5.jpg)

AMD, Nvidia Lead Chip-Stock Rally as Semiconductor Tariff Worries Ease - Investopedia

Read More

Intel CEO's plan may focus on design, getting Nvidia, Broadcom as foundry customers: UBS (INTC:NASDAQ) - Seeking Alpha

Read More

One Last Trip To Philadelphia’s Department Store Of Dreams - Defector

Read MoreHeathrow defends its response as questions grow about why a fire shut the airport for so long - The Associated Press

Read More

Police find 'suspicious' devices at Tesla showroom in North Austin - KUT

Read More